Local property insurance is a vital aspect of safeguarding your home and assets. Unlike generic national policies, local property insurance providers offer tailored coverage that accounts for the unique risks and conditions specific to your region. This article will explore the importance of Local property insurance, its benefits, and tips for choosing the right coverage for your needs.

Why Choose Local Property Insurance?

- Community Knowledge: Local insurance providers understand the specific risks associated with your area, such as natural disasters, crime rates, and local building codes. This localized knowledge allows them to offer policies that directly address the needs of their clients.

- Personalized Service: Local insurers often prioritize relationships over transactions. This can lead to more personalized service, faster claims processing, and better communication. If you have questions or need assistance, you’re more likely to receive prompt and relevant support from a local agent.

- Tailored Coverage Options: Local companies can provide customized insurance solutions that reflect your individual property needs, including specific endorsements that might not be available through larger, national insurers. This flexibility ensures you have the right protection in place.

- Support for the Local Economy: Choosing a local property insurance provider helps support the economy in your community, fostering job growth and local investment.

Key Components of Local Property Insurance

- Dwelling Coverage: This core component protects the physical structure of your home against damages caused by covered perils, such as fire, theft, or vandalism.

- Personal Property Coverage: This coverage extends to your personal belongings, such as furniture, electronics, and clothing. It safeguards against loss or damage, providing peace of mind.

- Liability Protection: Local property insurance often includes liability coverage to protect you in case someone is injured on your property. This covers medical expenses and legal fees associated with accidents.

- Additional Living Expenses (ALE): If your home becomes uninhabitable due to a covered event, this component provides for temporary living expenses, such as hotel costs and meals.

Tips for Choosing Local Property Insurance

- Assess Your Needs: Evaluate the value of your home and belongings, as well as potential hazards specific to your area. Understanding these factors will help you determine the type and amount of coverage you need.

- Research Local Insurers: Take the time to research and compare local insurance providers. Look for companies with a solid reputation and positive customer reviews. You can also ask for recommendations from friends or family.

- Request Multiple Quotes: To ensure you’re getting the best rate, obtain quotes from several local insurers. This allows you to compare not only premiums but also coverage limits and policy terms.

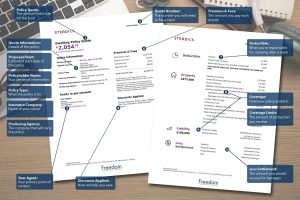

- Understand the Policy Details: Read through the fine print of each policy carefully. Pay attention to what is covered, what is excluded, and any limitations that may apply. Understanding the terms will help you make a well-informed decision.

- Inquire About Discounts: Many local insurers offer discounts for various reasons—bundling policies, having security systems in place, or being a long-time customer. Be sure to ask about any available discounts that could lower your premium.

Conclusion

Local property insurance is an essential investment that protects your home and personal belongings from unforeseen events. By choosing a local provider, you benefit from their expertise and knowledge of the specific risks associated with your community. Taking the time to understand coverage options, assess your needs, and shop around for the best policy will ensure you make a well-informed decision. With the right local property insurance, you can protect your investment and enjoy peace of mind knowing that you’re covered in times of need.